April Inflation Update

Inflation is decreasing. Why doesn't it feel better?

Note: I visited my parents in San Diego this weekend; this week's post is lighter than others.

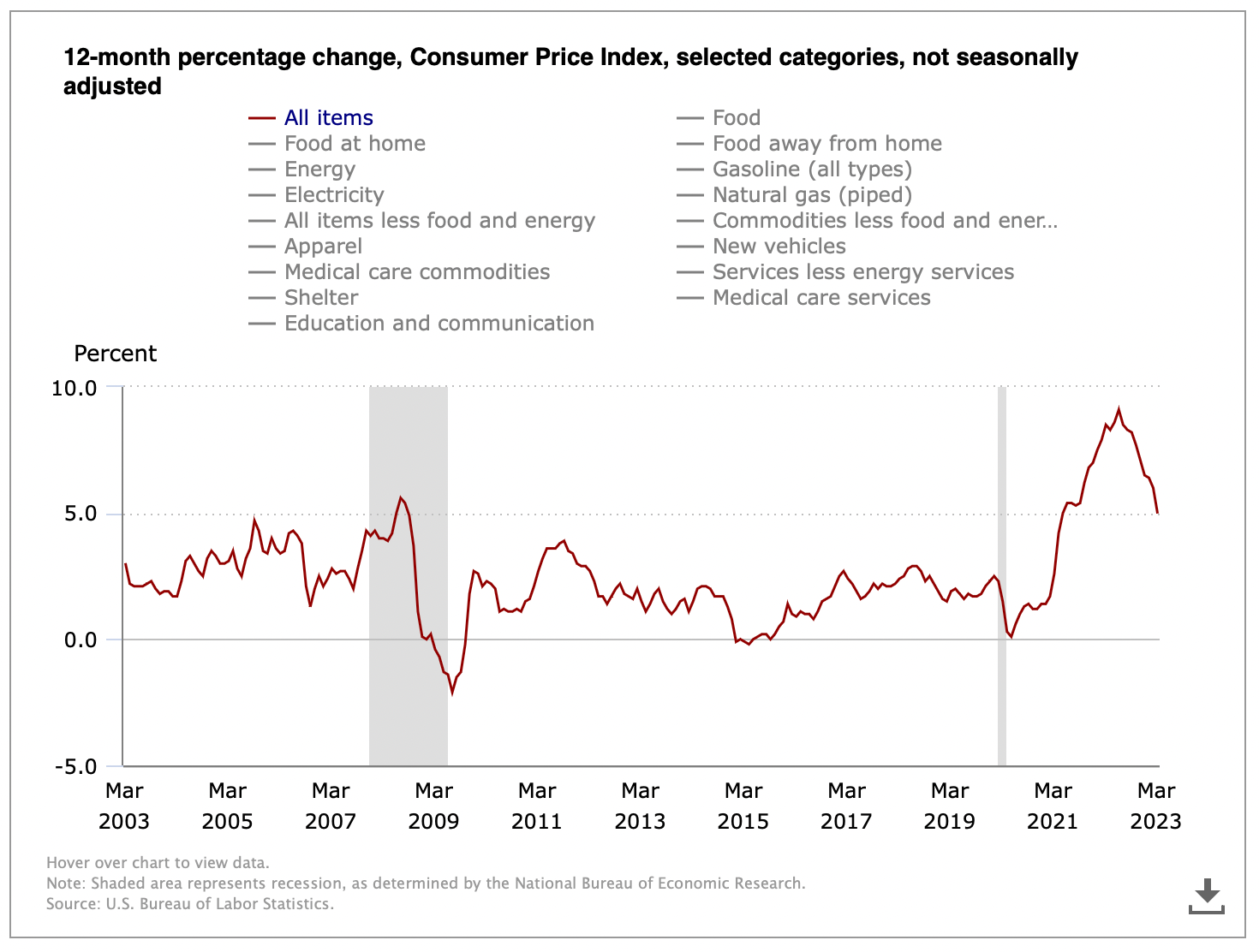

Inflation is Decreasing

If we look at the latest U.S. Bureau of Labor Statistics report, inflation is decreasing.

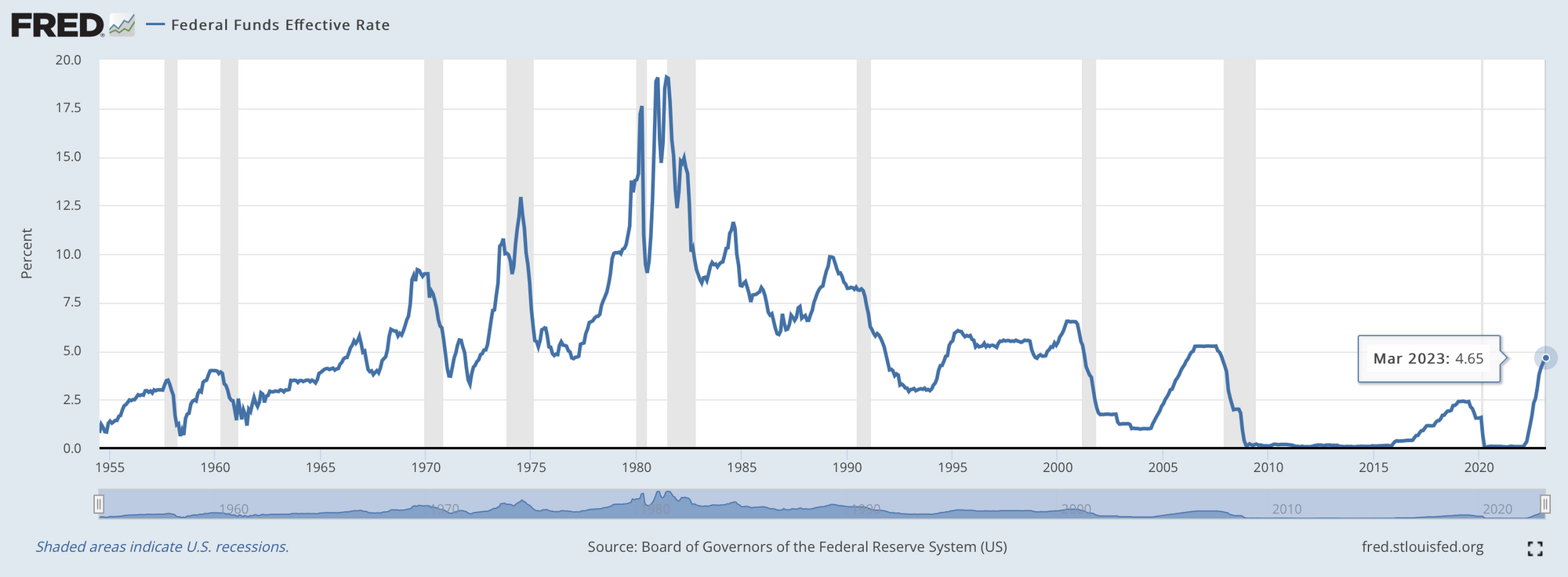

The Fed Funds Rate and Inflation

I wrote about inflation a while back in September. I predicted we would raise the Fed Funds Rate significantly in my post. My original prediction was that:

By September 2025, we may see rates between 9-13% for the Federal Reserve Funds Rate.

We're currently at a Federal Funds Effective Rate of 4.65% (March) with a current target of 4.75 - 5.00%.

Shaky Economy in California

While inflation is decreasing, we have layoffs, increasing housing costs, and more. With decreased tech and media taxes, we also have budget shortfalls at the state and city levels.

Are we allowed to feel happy that inflation is decreasing? Or is the Fed's strategy working? And now we're just dealing with the consequences of higher interest rates?

Related reads:

- California Economy Is on Edge After Tech Layoffs and Studio Cutbacks - The New York Times

- A comprehensive list of 2023 tech layoffs - TechCrunch

- There's a "morale crisis" at Meta - Axios

Additional ways to decrease Inflation

In my post about the Fed Rates Hike, I argue that the Fed Funds Rate is one of the many tools we can use to combat inflation.

We could:

#1 Raise taxes to bring down inflation

Recently, Jon Stewart did a great job summarizing several of my points. He interviewed Larry Summers, the Former Secretary of the Treasury.

Jon Stewart's and my general thesis is, "Why are working people being blamed for inflation?"

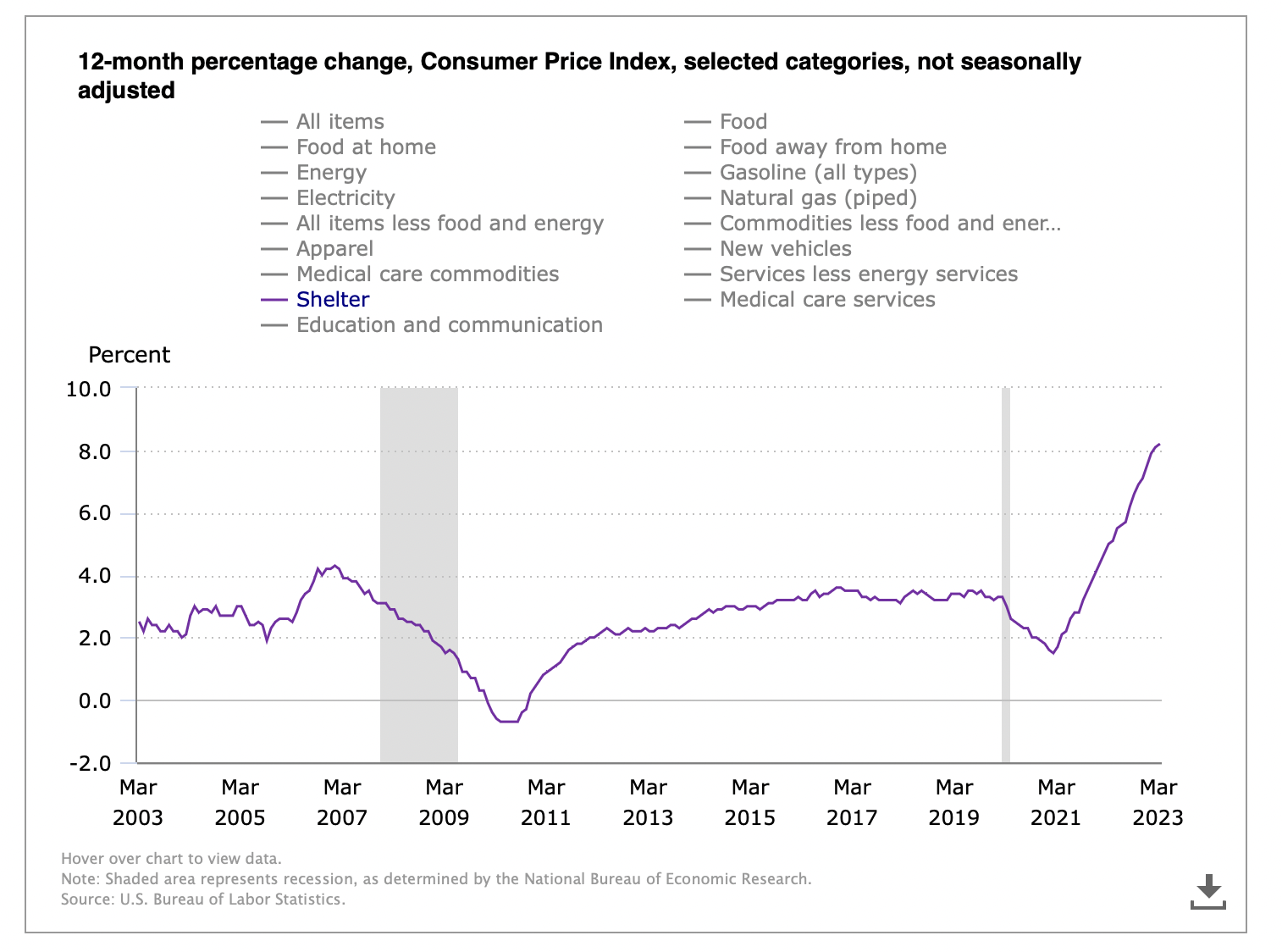

#2 Build more housing to bring down the price of rent

The most significant contributor to our inflation is shelter (e.g., housing).

In the latest Consumer Price Index Update, shelter costs continue to drive up inflation.

The index for shelter was by far the largest contributor to the monthly all items increase. This more than offset a decline in the energy index, which decreased 3.5 percent over the month as all major energy component indexes declined. The food index was unchanged in March with the food at home index falling 0.3 percent. - Consumer Price Index Summary

If we were to take an economic view of the situation, Demand is outstripping supply, and we should increase the housing supply.

My dad is a hardcore NIMBY (my parents are based out of San Diego). I understand where he comes from. However, the reality is that we do need our cities to evolve and change.

That's why projects like 2700 Sloat Boulevard will help reduce housing prices.

Not every project should look or needs to look like 2700 Sloat Boulevard. However, San Diego, LA, and the Bay Area should have 6-story buildings everywhere and not just in city centers.

We can keep raising the Fed Funds rate to battle inflation. If housing costs continue increasing, then maybe my original prediction of 9-13% isn't so far off. However, if we do something structurally about housing costs, perhaps it doesn't need to go as high.

Email me or comment below if you have additional ideas to reduce inflation.