Cap table diversity: What is it? Why does it matter?

Cap table diversity isn't discussed as the top way to improve diversity in tech, but it should be. It's effective and has proven results.

Cap table diversity isn’t discussed as the top way to improve diversity in tech, but it should be.

A capitalization table, also known as a cap table, is the table of percentage ownership inside a company. Cap tables are essential for founders, employees, and investors. Much of the wealth created in Silicon Valley has been created from cap tables and their success being on them.

Importance of diversity

For me, diversity is a constant thought and practice. It’s been top of mind in how I’ve built teams in the past, how I view the world, and ultimately what makes the most sense strategically for every company. You can make the best decisions and become more successful with a more diverse group, company, or investment committee.

Teams of diverse founders (more than one gender and/or more than one race or ethnicity represented) create more innovation and, on average, better financial outcomes at venture-funded startups, including 30% higher multiples on invested capital (MOIC) when companies are acquired or go public, plus better valuations for startups with at least one female founder (63% better than all-male teams) and/or with at least one ethnically-diverse team member reporting to the CEO (65% better than all-white teams).Forbes

Historical conversations on diversity

Most conversations in the past have focused on improving diversity in big tech. The discussions have pushed leaders to hire diverse senior leaders and train people for tech roles using boot camps. Unfortunately, we’ve had progress, but not as much as everyone wanted and pushed for.

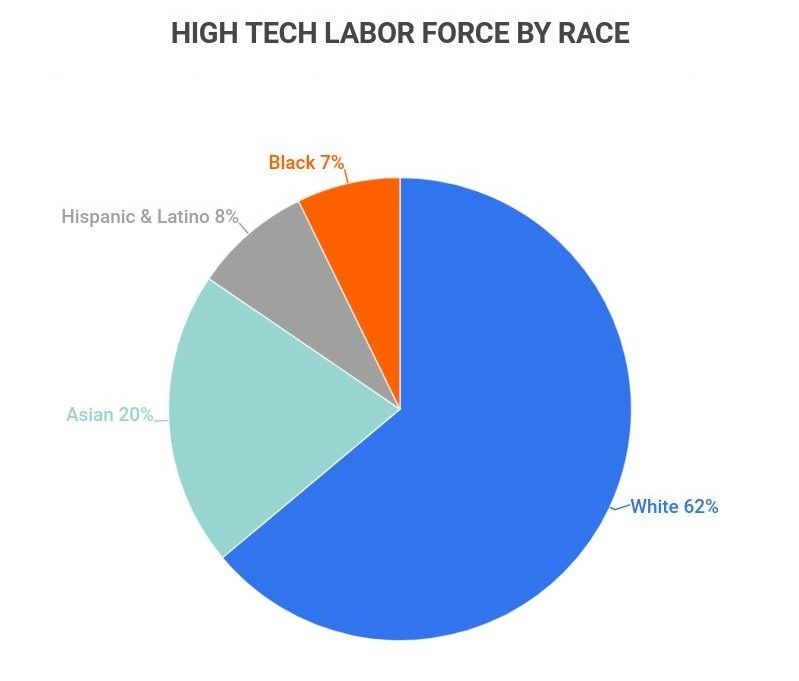

Diversity in big tech by ethnicity

According to Zippia, 62% of jobs in the US tech sector are held by white Americans. Black Americans hold 7% of jobs, Latinx Americans hold 8% of jobs, and Asian Americans hold 20% of jobs.

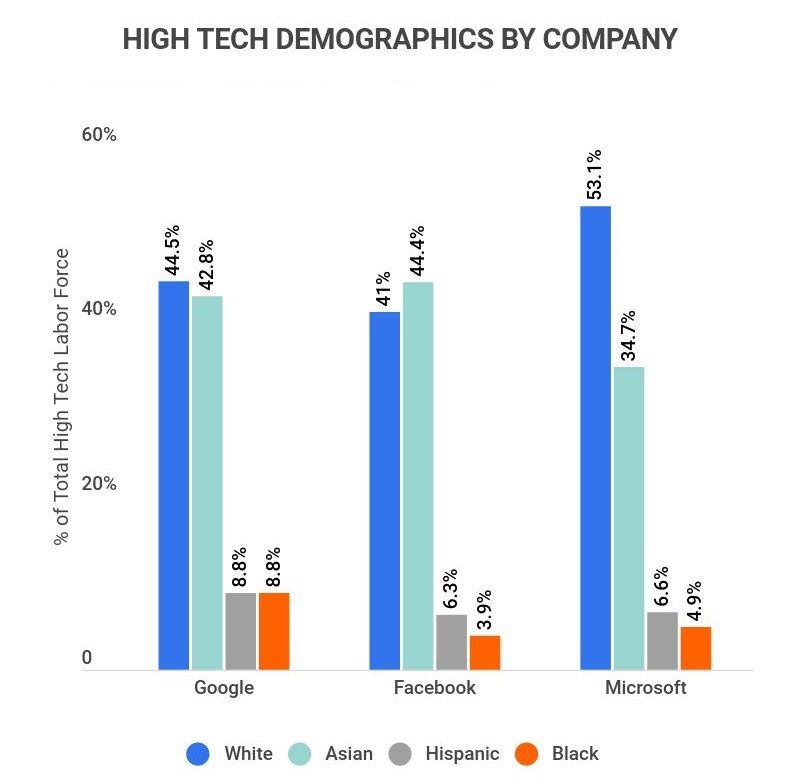

Let’s examine the three most prominent companies: Google, Facebook (Meta now), and Microsoft. You can see the percentage of Hispanic and Black employees is not very high compared to the racial makeup of the United States.

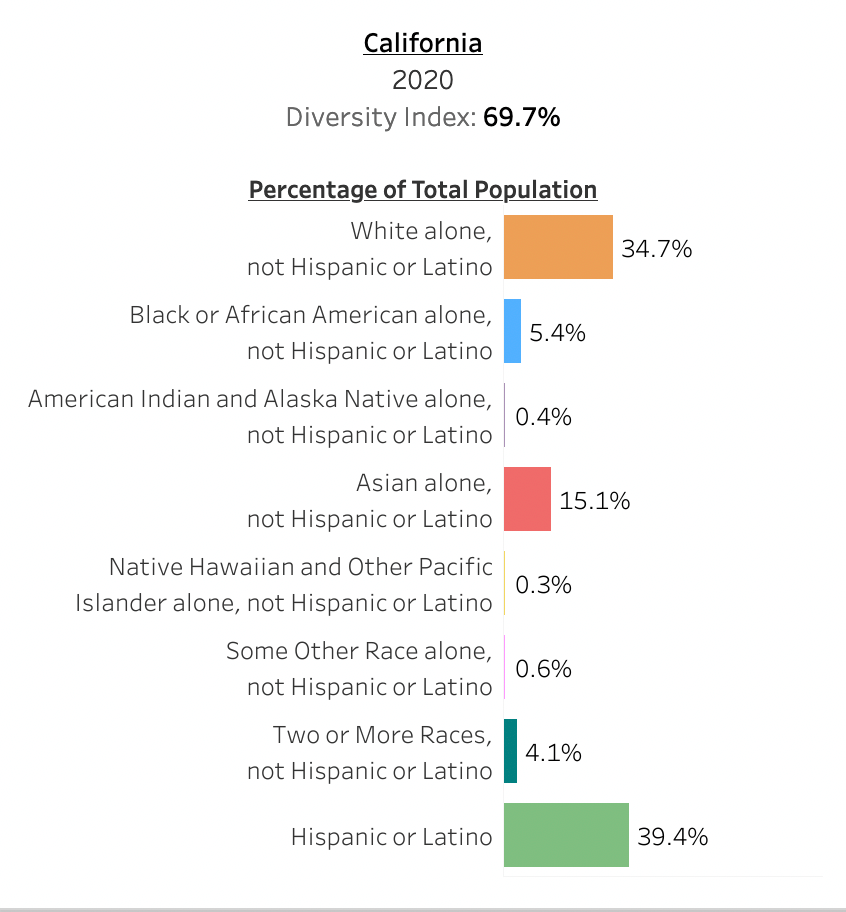

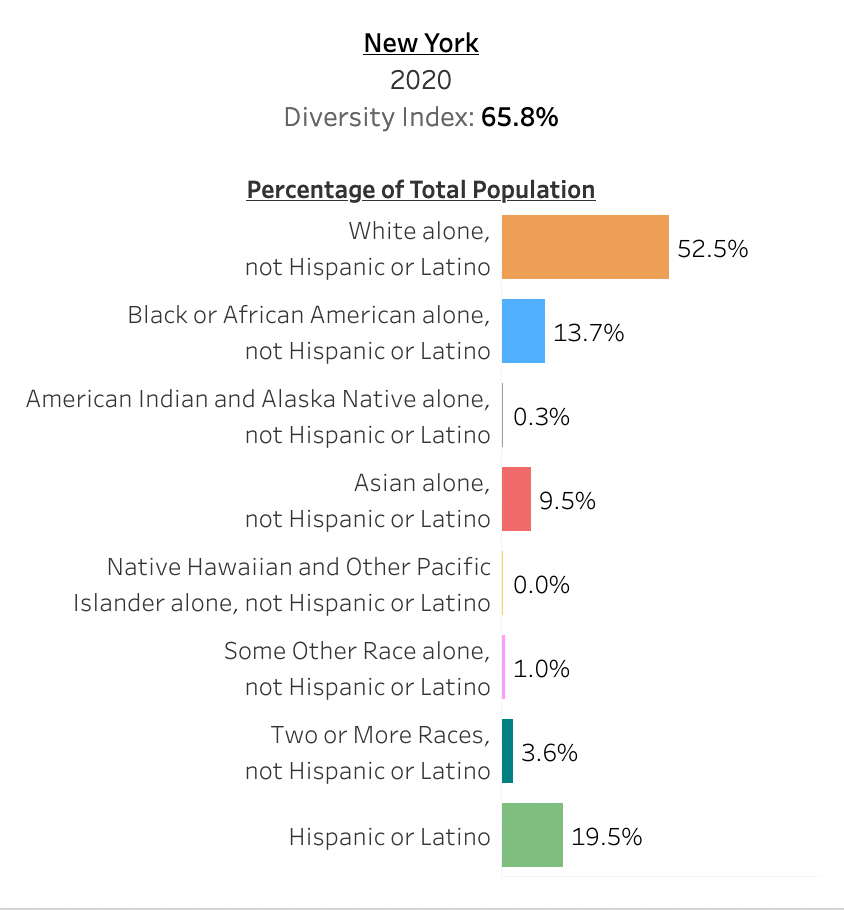

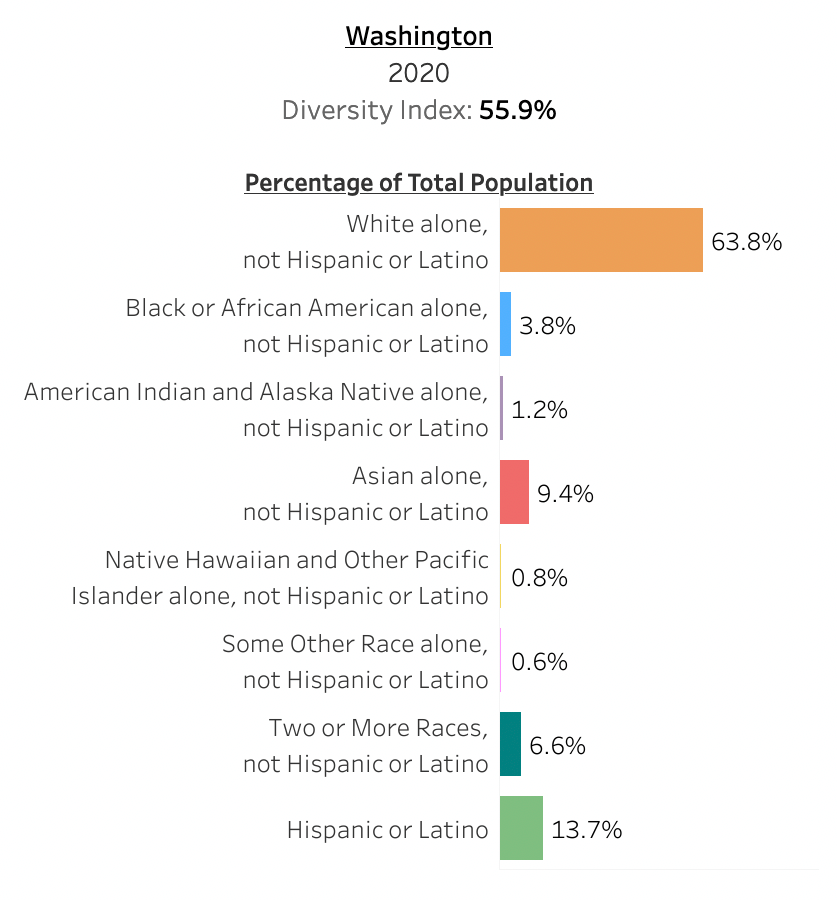

In contrast, you can compare the ethnic diversity of California, New York, and Washington Below. You’ll see that the Latino and Black populations are underrepresented in the data above. In California, 39.4% of the state is Hispanic or Latino. Yet Google (headquartered in Mountain View, CA) and Facebook (headquartered in Menlo Park, CA) have an 8.8% and 3.9% Hispanic tech force.

You can view more of this data here.

Diversity in big tech by gender

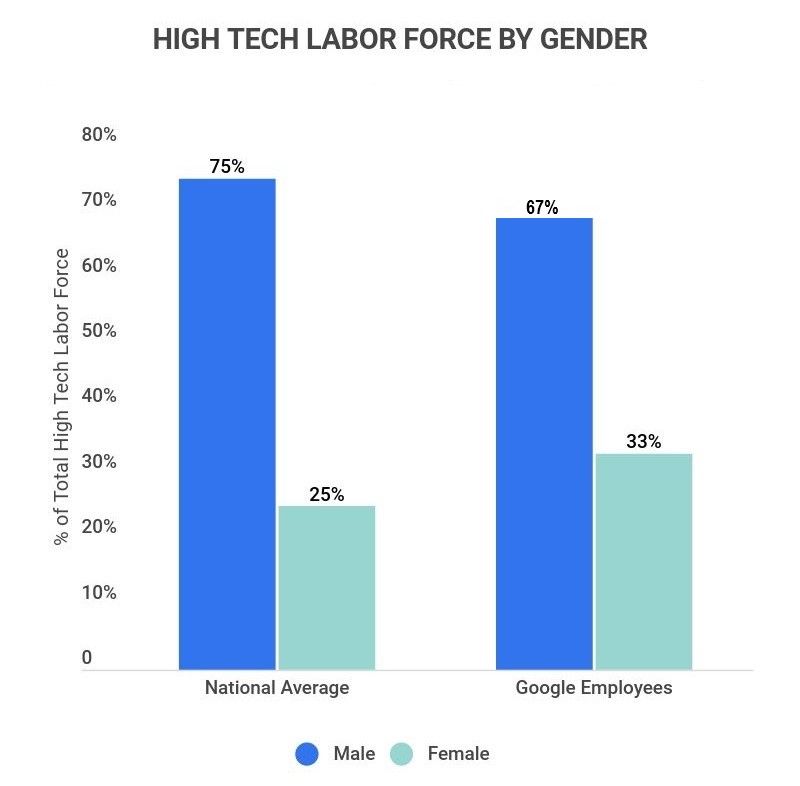

Ethnicity is only one way to look at diversity. Gender is another big divide in tech. On average, the tech labor force is 75% male.

When you factor in race and gender, the divide gets even larger. Just 3% of computing-related jobs are held by African-American women, 6% held by Asian women, and 2% held by Hispanic women [1].

Diversity in senior leadership

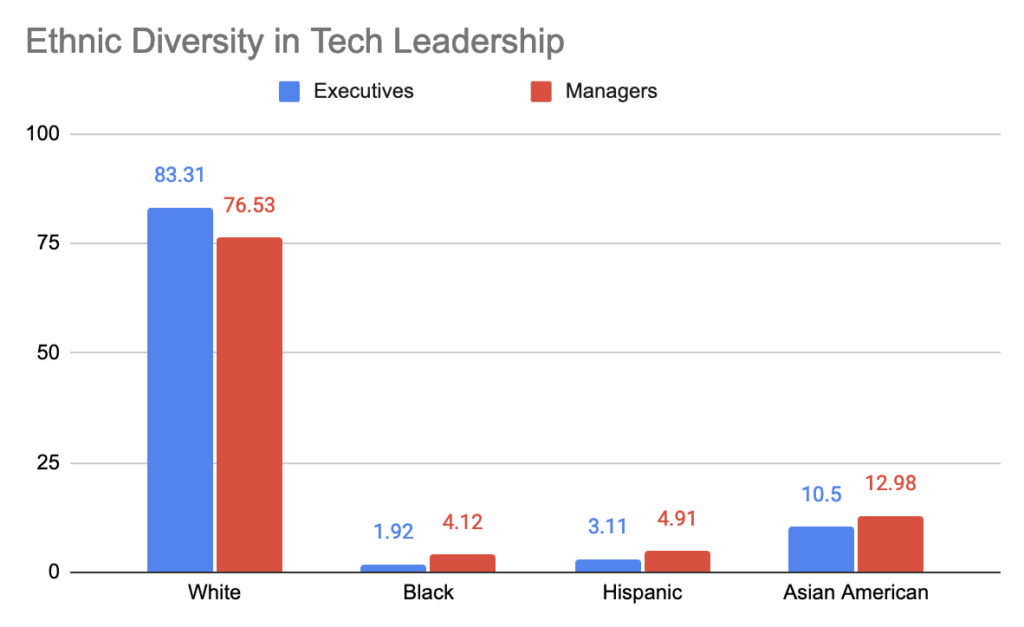

The disparity becomes the largest if we also look at the percentage of senior leaders at tech companies. According to the U.S. Employment and Opportunity Commission, “Whites and men dominated high tech leadership positions as Executive/Senior Level Officials and Managers (Executives) and First/Mid-Level Officials and Managers (Managers) nationwide, and dominated even more strongly in the Silicon Valley geographic area.” [2]

When we look at Ethnic diversity, just 1.92% of executives are Black, 3.11% Hispanic, and 10.5% Asian American.

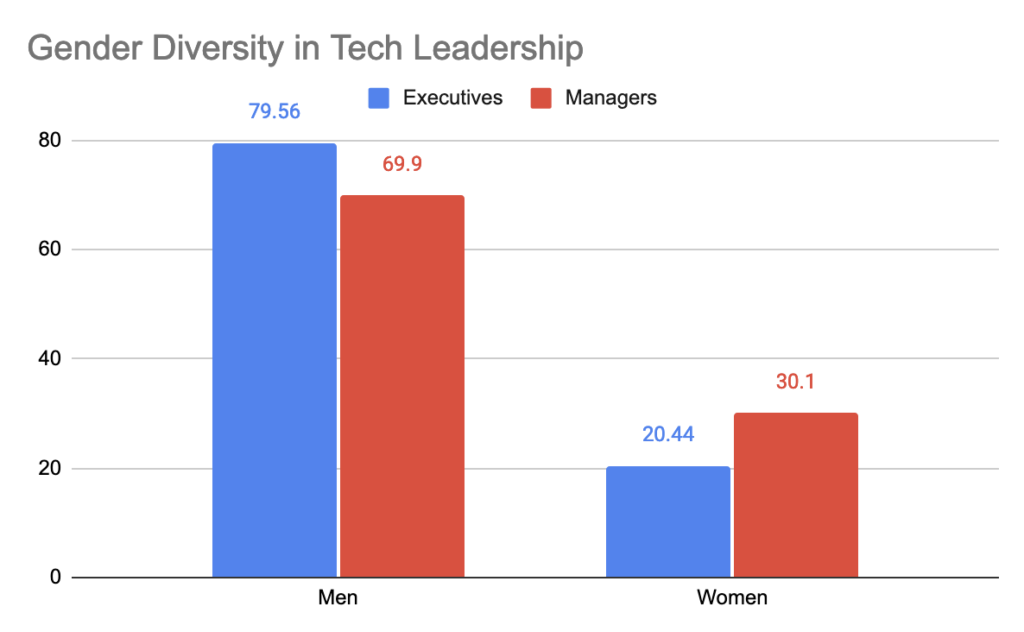

When we look at gender, 79.56% of executives are male vs. 20.44%.

How do we improve diversity in tech?

Now that we’ve established a significant lack of diversity in tech, what do we do about it? Broadly, there are roughly four areas of focus that we can tackle and spend time, energy, and money on:

- Pushing big tech to be diverse (Includes hiring diverse and underrepresented senior leadership)

- Increasing the number of diverse and underrepresented founders

- Increasing the number of diverse and underrepresented investors (cap table diversity)

- Legislation to increase diversity

In the many years of discussions with friends, colleagues, mentors, and numerous talks I’ve attended, diversity in the cap table hasn’t been a top discussion in my circles, but it should be.

Admittedly, cap table diversity isn’t where I focused my energy earlier. I’ve always thought that the only way to fix diversity in tech is to focus on diverse founders because everything else doesn’t have as much Return on Investment (ROI).

I’ve been doubtful of big tech meaningfully changing for many reasons. In my experience, large companies can perform acts of diversity that can be performative vs. results-oriented. They sometimes recruit diverse senior leadership but do not hear their ideas or implement changes. Bozoma Saint John much more eloquently talks about this in her latest podcast and references her departure from Netflix as CMO. In other cases, companies hire Chief Diversity and Inclusion Officers and equip them with no headcount, budget, or power to make structural changes.

One of the reasons I’ve always been entrepreneurial is because I thought the only way to impact diversity in a significant way is to be a founder myself or help other diverse founders.

Shifting my perspective to cap table diversity

In hindsight, I was wrong in thinking the founder’s focus was the highest ROI in making tech diverse. I now believe we need to focus our energy on pushing companies to have diverse cap tables. Here’s why:

1. Diverse investors provide talent economies of scale

There are usually 1-4 co-founders in every company. In contrast, there can be 10-20 different investors (angels, venture capitalists) in the early fundraising rounds. When startups start to grow, they need great talent. Investors can help provide a steady talent pipeline, deals, and potential customers.

Companies are less likely to get diverse employee referrals, deals, and partnership opportunities with a predominantly white male investor cap table. Diverse investors have relationships, communities, and networks that recruit more diverse talent than their white male counterparts.

2. Diverse and under-represented Investors need wins to progress in their career

Focusing on cap table diversity unlocks opportunities for investors to progress in their careers and ultimately shift the current status of Venture Capital (VC) diversity.

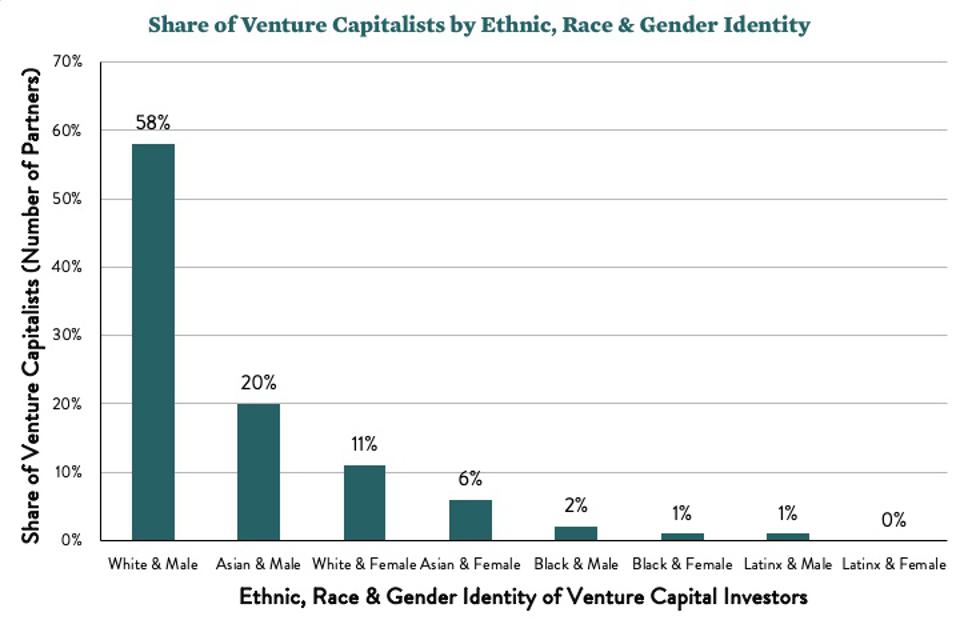

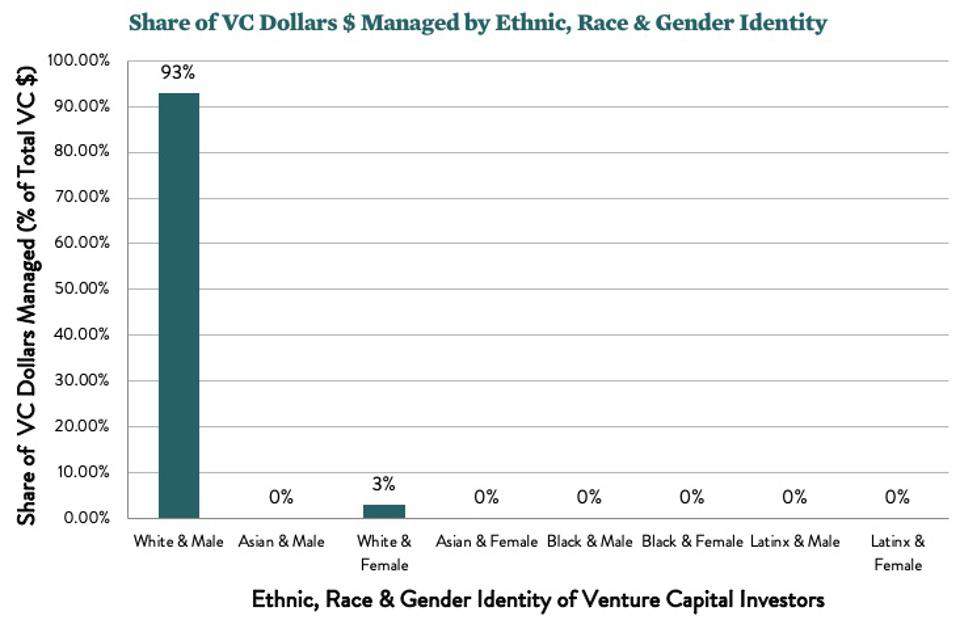

Only three percent of VC investors are Black and only 1.7% of VC-backed startups have a Black founder. The number of Latinx founders in VC-backed startups is even lower — 1.3%. Plus, only 2.4% of funding was allocated to Black and Latinx founders from 2015 to August 2020. And, on the startup boards of high tech companies, women hold a mere 8% of the board seats. [3]TechCrunch

Diversity statistics in Venture Capital (VC) often include employees that aren’t managing partners or are directly involved in investment decisions. Diversity statistics include analysts, scouts, and employees dedicated to due diligence. The results are much bleaker than the chart above if you optimize for who manages VC dollars.

To progress in Venture Capital and as an investor, you need wins. However, sometimes you can’t get into a round because you aren’t connected enough. Fundraising can be challenging, but it can also be exclusionary for founders and investors. For some elite funding rounds, the final investors are not that diverse. Many of the investors are either business school friends or past colleagues, which can have profound effects on limiting diversity.

As a Stanford graduate, I’ve seen and personally benefited from the importance of networks and relationships. Being an under-represented investor can make it harder to succeed if you don’t have these pre-existing networks and relationships. Focusing on cap table diversity can open up currently closed doors to under-represented investors.

3. Diverse and under-represented investors that control investment decisions are more likely to fund diverse and under-represented founders

Diverse and under-represented founders are more likely to invest money in other founders. Not increasing the pool of diverse and under-represented investors impacts the dollars invested in female and underrepresented founders.

According to a 2019 report by James L. Knight Foundation, just 1% of the $70 trillion wealth management industry is controlled by women or minority fund managers, which often directly impacts the number of dollars invested in female and underrepresented founders.Forbes

Investing in diverse and under-represented founders also makes a lot of economic sense. Here are some stats below (source):

- 40% of US businesses are owned by women, with 64% of new women-owned businesses being started by women of color.

- In 2016, women only received about 2% of total investor funding, and women-led businesses made up just 4.9% of all VC deals.

- Though 79% of women entrepreneurs feel more empowered than five years prior, 66% still are finding it difficult to obtain the money they need to succeed

4. Diverse and under-represented networks provide economies of scale

Diverse investments can have a significant force multiplier on the economy. As diverse founders get more funding and under-represented investors move towards partner or even start their own fund, their time and money can be invested into future generations.

One day Silicon Valley will look much different than it does now, and I hope it will be more diverse and inclusive than it is now.

We have to ask the question: how fast do we want this to happen? (Note: Of course, I want it now)

How Cap Table Coalition is improving diversity on cap tables

This post was inspired by the 1 year anniversary of the Cap Table Coalition. The Cap Table Coalition aims to diversify the VC ecosystem by creating investment opportunities for Black, Latinx, LGBTQ+, Native American, women, and other traditionally marginalized investors. I’ve been in awe of Cap Table Coalition’s progress and the hard work many people are spending to make Cap Table Coalition a success.

It’s a major team effort and I want to specifically thank Emanuel Pleitez, Qiana Patterson, Alejandro (Alex) Guerrero (author of The Diversity Rider and inspiration for The Cap Table Coalition), The Cap Table Investment Committee, Cenobio Hernandez, Carolyn Reynolds, Nina Ohiku, Richie Serna, and Jareau Wade have been a big force in making Cap Table Coalition the success that it is today. There is a large community behind the Cap Table Coalition and many more to thank for their pledges, support, money, and time contributed.

Here’s how the Cap Table Coalition can help:

- For High Growth Startups: Take the Cap Table Pledge to diversify your company’s cap table and help rewrite the story about the lack of diversity in venture capital and technology as a whole.

- For Venture Capital Firms: Use the Diversity Rider to create more investment opportunities for emerging fund managers in your term sheets. Diverse funders improve investment returns while equalizing opportunity for wealth creation.

- For Investors: Calling all Black, Latinx, women, and LGBTQ+ check writers! Join our community to get access to new networks and proprietary deal flow and build your track record—and hopefully, start your own fund one day.

Cap Table Coalition’s Proven Track Record

Over the last year, Cap Table Coalition has had a proven track record and already started to reshape Silicon Valley.

- 119 high-growth startups (including Finix) have taken the Founder’s Pledge, dedicating 10% or more of all funding to traditionally marginalized investors.

- The Cap Table Coalition community has grown to over 700 Black, Latinx, LGBTQ+, Native American, women, and other traditionally marginalized investors.

- Cap Table Coalition investors have deployed $27.1 million to 48 completed funding rounds, with more on the way

Richie Serna, Finix’s (disclosure: my employer) CEO, commented:

The Coalition is about more than just increasing representation on cap tables. It’s about helping those of us from historically marginalized groups get attribution for our work to help jumpstart our careers and, hopefully, one day our own funds. From there, more money and time can be invested back into our communities to inspire the next generations of startups and founders. Eventually, we hope, the downstream impacts will change the face of Silicon Valley and technology as a whole forever.Richie Serna, Co-Founder & CEO, Finix

Past Investments by Cap Table Coalition

Cap Table Coalition has had a lot of deals (48 rounds and more on the way). Below, you can see a showcase of a few of them.

Next Steps

- If you work for a tech startup, talk to your leadership team to take the Cap Table Pledge to Commit to making at least 10% of your round available to under-represented investors.

- If you work at a venture fund, use the diversity rider to create more investment opportunities for emerging fund managers in your term sheets.

- If you work for a large public company, learn more about the Cap Table Coalition and see if you can refer your diverse and under-represented investors to the Cap Table Coalition.

- If you don’t work in tech and still want to help, share this post in your networks and amplify the work many are doing to make Silicon Valley more diverse.

Inclusion Note

I mainly discussed diversity in this post and didn’t focus on inclusion. To foster a great community and retain diverse employees, making them feel included is essential.

According to Allaya Cooks-Campbell, “Inclusion is the “secret sauce” that makes a diverse workplace more innovative, profitable, and engaging. It means creating an environment where people — regardless of surface or hidden level differences — feel welcome and valued. That means no individual is denied access to education, resources, opportunities, or any other treatment based on the qualities that make them unique, whether intentionally or inadvertently.” [4]

In a future post, I’ll write specifically on Inclusion.

Additional Reads

References

[1] – https://builtin.com/women-tech/women-in-tech-workplace-statistics

[3] – https://techcrunch.com/2021/08/29/diversifying-startups-and-vc-power-corridors/