Sunday Read No. 2: Pride Month, Roe v Wade, Colombia's President, Crypto Margin Calls

I’m continuing a Sunday Read series. I hope you enjoy this new format.

I’m continuing a Sunday Read series. I hope you enjoy this new format.

Pride Month

Happy LGBTQ+ Pride month to everyone! San Francisco’s pride parade and celebration kicked off today for the first time in two years.

I wasn’t able to attend the parade but was able to attend the celebration in Civic Center. It was a blast to see everyone celebrating LGBTQ+ people, history, and culture.

While Pride Month (June 1 to June 30) is drawing to a close, fighting for LGTBQ+ rights and acceptance continues.

View photos of San Francisco Pride

Roe v. Wade Ruling

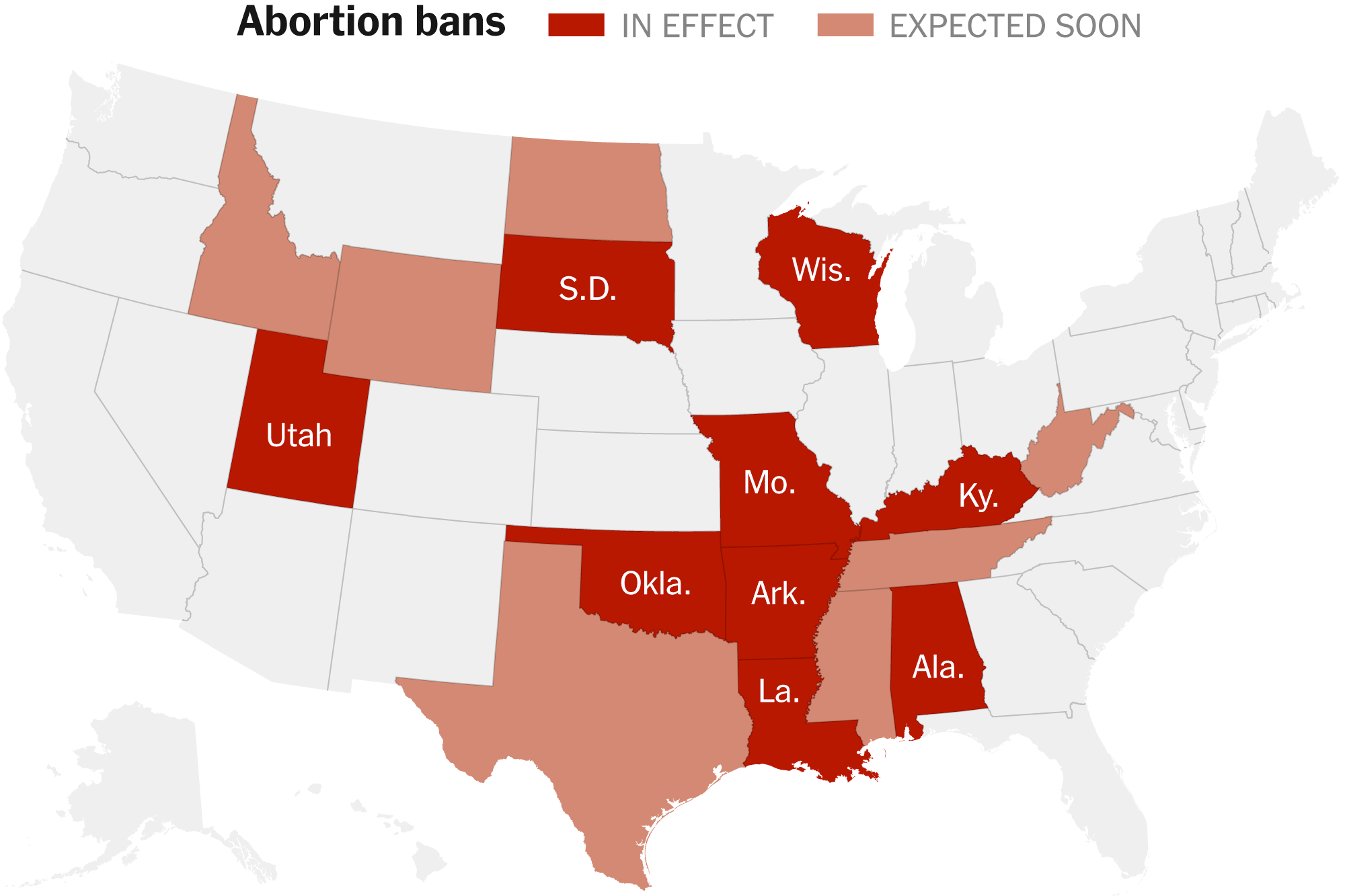

On June 24, 2022, the Supreme Court overturned Roe v. Wade, eliminating the constitutional right to an abortion after almost 50 years. Roe’s fall immediately triggered abortion bans; nine states now ban the procedure in most cases. More than 20 states appear set to outlaw all or nearly all abortions.

It would be negligent to write my newsletter and not mention this historic ruling that affects the rights of women throughout the United States. Regardless of your personal beliefs on abortion, women and their doctors are the best people to make that decision.

There are deeply negative consequences to the ruling that will likely reduce abortion access most for lower-income women and Black and Hispanic women who lack the resources to travel to obtain one. (NYTimes)

Colombia’s First Leftist President

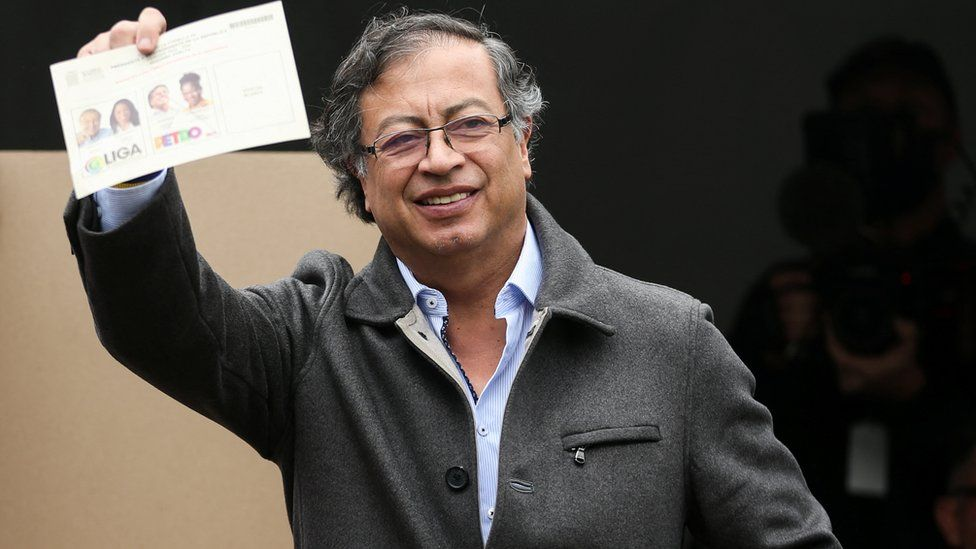

Gustavo Petro will be Colombia’s first leftist president signaling a new era of politics for Colombia. Gustavo was previously a guerrilla fighter, mayor of Bogota, and senator before winning his election.

When Gustavo Petro joined Colombia’s M-19 guerrilla movement in the late 1970s, he assumed the nom de guerre Aureliano in homage to Colonel Aureliano Buendía, a character in Gabriel García Márquez’s masterpiece One Hundred Years of Solitude. The choice was apt. Like the fictional colonel, Petro is a dogged survivor of setbacks, defeats and attempts on his life.Financial Times

Gustavo’s policy platform includes plans to vastly expand social programs, providing a significant subsidy to single mothers, guaranteeing work and a wage to unemployed people, bolstering access to higher education, increasing food aid, shifting the country to a publicly controlled health care system and remaking the pension system. (NYTimes).

Colombia and oil

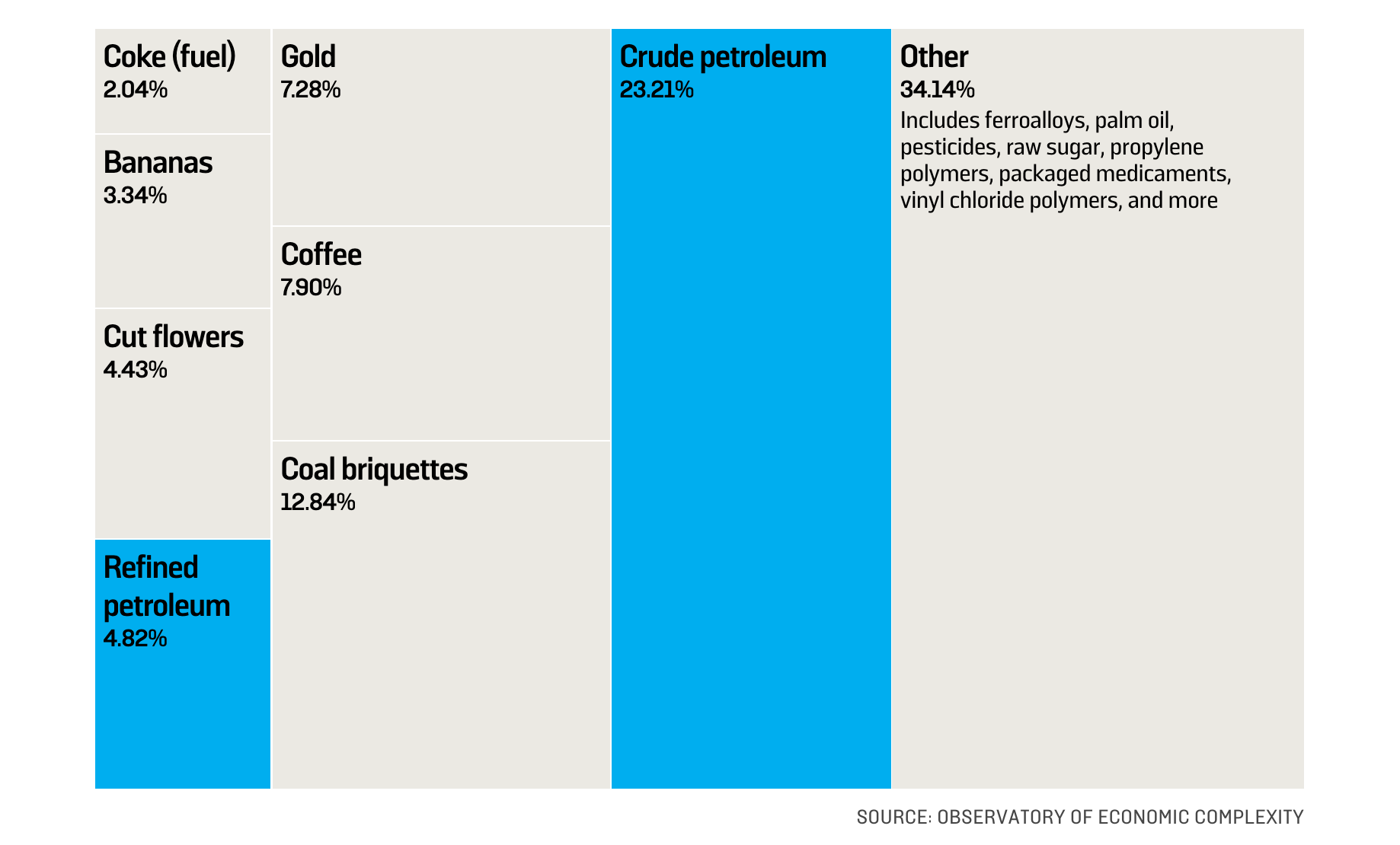

One of Gustavo Petro’s more ambitious plans is to move Colombia away from being a major exporter of oil. This is in stark contrast to many other Latin American presidents (Mexico doubled down on oil) and even the United States.

Discussing Colombia on last week’s episode of Ones and Tooze, historian and FP columnist Adam Tooze praised Petro’s plans as “just sensible,” adding that “there’s very good reason to think that Colombia suffers from so-called Dutch disease,” in which dependence on oil exports drives up the value of a country’s currency and makes other branches of the economy less competitive. Multiple scholars have argued the same about Colombia; if executed well, shifting away from oil could be a remedy.Foreign Policy

Colombia and startups

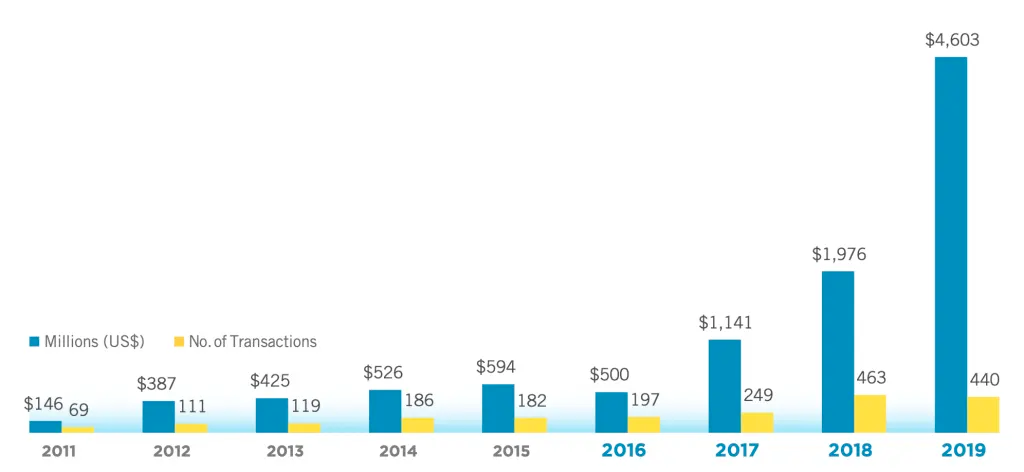

Colombia is one of the capitals of innovation in Latin America. Colombia has a strong tech scene with companies such as Addi (BNPL for Latin America), UBITS, (Employee training for Latin America), and Lifit (Last-mile delivery). Bogota and Medellin serve as two of the largest tech hubs with easy flights to the United States.

In 2019, LatAm’s venture capital financing amount exceeded 4.6 billion US dollars, of which Colombia’s financing amount alone was as high as 1.09 billion US dollars, which ranked second in LatAm, far exceeding Mexico, Argentina, Chile, and other countries (Polymath Ventures)

Are Latin American governments moving to the left?

An interesting trend to track is the current political climate in Latin America swinging to the left. Personally, I’m very left (I consider my politics a 95-99% match with Alexandria Ocasio Cortez and Working Families Party), so I do welcome this advance. However, everything is relative and so in the grand scheme of the world, I’m not that left (very anti-climatic I know).

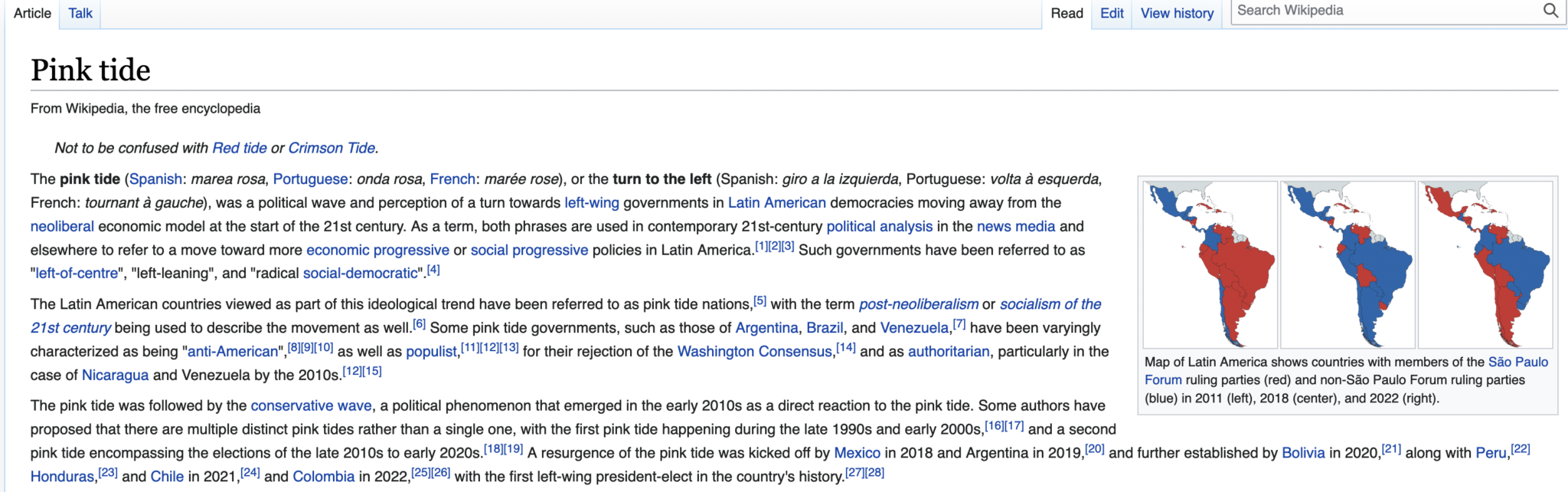

After noodling on this over the weekend, being on the left or right in Latin America means different things than being on the left or right in the United States. After some research, there is actually a term for swinging back and forth in Latin America, it’s called Pink Tide!

Reader Note: I‘m curious to see how Gustavo Petro’s presidency turns out. I’ve been a cautious fan of AMLO, Mexico’s Leftist President, so I would say I’m in a similar position here.

Crypto Margin Calls

As we continue in this bear market, I can imagine a number of partner and senior executive meetings like the ones above.

Many may face margin calls as the price of Bitcoin, Ethereum, and other coins remain significantly lower than they were at the beginning of the year.

According to Investopedia:

- A margin call occurs when the value of an investor’s margin account falls below the broker’s required amount. An investor’s margin account contains securities bought with borrowed money (typically a combination of the investor’s own money and money borrowed from the investor’s broker).

- A margin call refers specifically to a broker’s demand that an investor deposit additional money or securities into the account so that it is brought up to the minimum value, known as the maintenance margin.

- A margin call is usually an indicator that one or more of the securities held in the margin account has decreased in value. When a margin call occurs, the investor must choose to either deposit additional funds or marginable securities in the account or sell some of the assets held in their account.

Celsius Networks

New Jersey-based Celsius, which has around $11.8 billion in assets, offers interest-bearing products to customers who deposit cryptocurrencies with its platform. It then lends out cryptocurrencies to earn a return (Reuters).

According to a Friday report from the Wall Street Journal, Celsius hired an unknown number of restructuring consultants from the firm Alvarez & Marsal to advise the platform on potentially filing for bankruptcy. The report followed one from June 14, which said Celsius had hired lawyers in an attempt to restructure the company amid its financial issues (CoinTelegraph).

With the likely outcome that Celsius Networks is looking to go under, many firms such as Goldman Sachs are looking to see if they can buy Celsius Network’s assets.

Three Arrows Capital (3AC)

Three Arrows Capital is another firm that is likely to go under from its debt obligations.

Cryptocurrency-focused hedge fund Three Arrows Capital Ltd. has hired legal and financial advisers to help work out a solution for its investors and lenders, after suffering heavy losses from a broad market selloff in digital assets.

Three Arrows Capital exposure could be massive:

- Which Projects Could Be Affected by 3AC’s Liquidity Crisis?

- Voyager Digital cuts withdrawal amount as 3AC contagion ripples through DeFi and CeFi

- Crypto Firm Voyager Digital Secures a $500M Line of Credit From Alameda Ventures to Cope With 3AC Exposure

What’s next for exposed crypto firms?

The question remaining is who is next and what exposure do they have? We’re likely to see more crypto firms go under over the next 4-5 months due to a sharp fall in crypto prices.

If it’s not crypto firms, it likely will be individuals which can negatively impact the economy. Exposed accredited investors will get hit hard by the market downturn. Fortunately, many will have a cushion to recover from an unsuccessful investment.

However, the effects for non-accredited and cash-strapped coin investors can be devastating if one of their investments fails (e.g. regular investors in Luna).

Recommended Reads

I recommend the following reads or listens this week: